Dolly Khanna is a renowned Indian investor known for her exceptional stock-picking skills. With a keen eye for identifying potential winners in the stock market, she has earned the admiration of many investors and traders. In this article, we will explore Dolly Khanna’s stock picks and gain insights into her investing philosophy.

Understanding Dolly Khanna’s Stock Picking Strategy

Dolly Khanna’s investment approach is centered around companies with strong fundamentals and sustainable growth prospects. She focuses primarily on small and mid-cap stocks, believing that these have the potential to deliver significant returns in the long run. Dolly is known for her patient and long-term investment style, which has rewarded her handsomely over the years.

Analyzing the Success of Dolly Khanna’s Stock Picks

Dolly Khanna’s stock picks have yielded remarkable results over the years. Her ability to spot hidden gems in the market and hold onto them with patience has been instrumental in her success. While not all her picks have been winners, her overall track record speaks volumes about her investing acumen.

Factors to Consider Before Following Stock Recommendations

Before blindly following any stock recommendation, including Dolly Khanna’s, investors should assess their own risk tolerance and financial goals. It is essential to conduct thorough research on the recommended companies, their financial health, and future growth prospects. Additionally, diversifying the investment portfolio can help mitigate risks.

Dolly Khanna’s Thoughts on Market Volatility

Market volatility is an inherent part of the stock market. Dolly Khanna advises investors to remain calm during turbulent times and avoid making impulsive decisions. She believes that focusing on the long-term potential of investments is more crucial than being swayed by short-term market fluctuations.

The Influence of Dolly Khanna’s Stock Picks on the Market

Dolly Khanna’s stock picks often garner attention from market participants, leading to increased trading activity in those companies’ stocks. Positive sentiment surrounding her investments can influence other investors’ decisions, impacting stock prices in the short term.

Dolly Khanna’s Advice to Aspiring Investors

For aspiring investors, Dolly Khanna offers valuable advice. She recommends staying disciplined, doing thorough research, and continuously learning from the market. While seeking guidance from successful investors is beneficial, she emphasizes the importance of developing one’s investment strategy.

Conclusion

Dolly Khanna’s stock picks have inspired many investors to explore potential opportunities in the stock market. Her knack for identifying promising companies and holding onto them with patience is a testament to her investing prowess.

As with any investment strategy, it is essential for investors to conduct their due diligence and make informed decisions.

FAQs

Dolly Khanna’s net worth is estimated to be around $70 millions, thanks to her successful investments.

While Dolly Khanna primarily focuses on Indian stocks, she may occasionally invest in international markets.

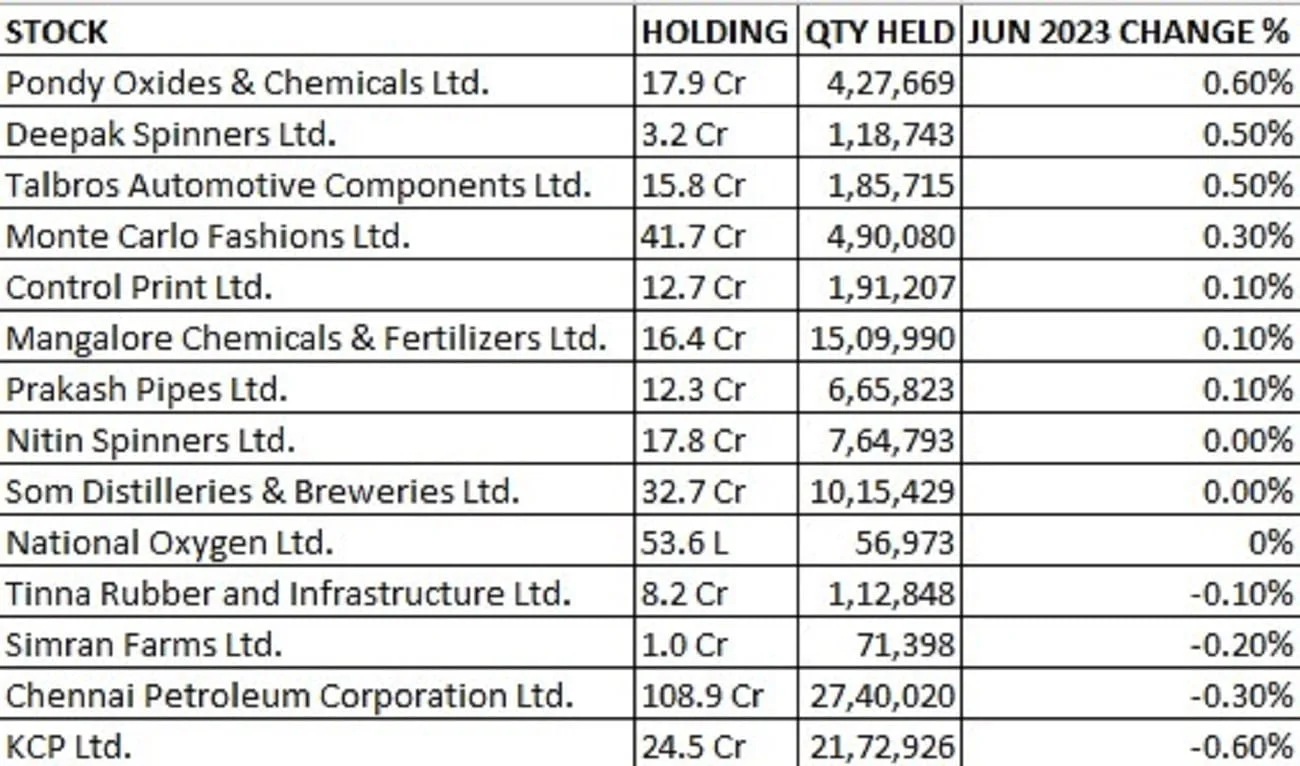

Dolly Khanna’s latest stock picks are often reported by financial media and websites dedicated to tracking market activities.

Blindly following any investment strategy is not advisable. It is essential to understand one’s own risk appetite and perform due diligence before making investment decisions.

Some other famous investors known for their long-term investment approach include Warren Buffett and Rakesh Jhunjhunwala.