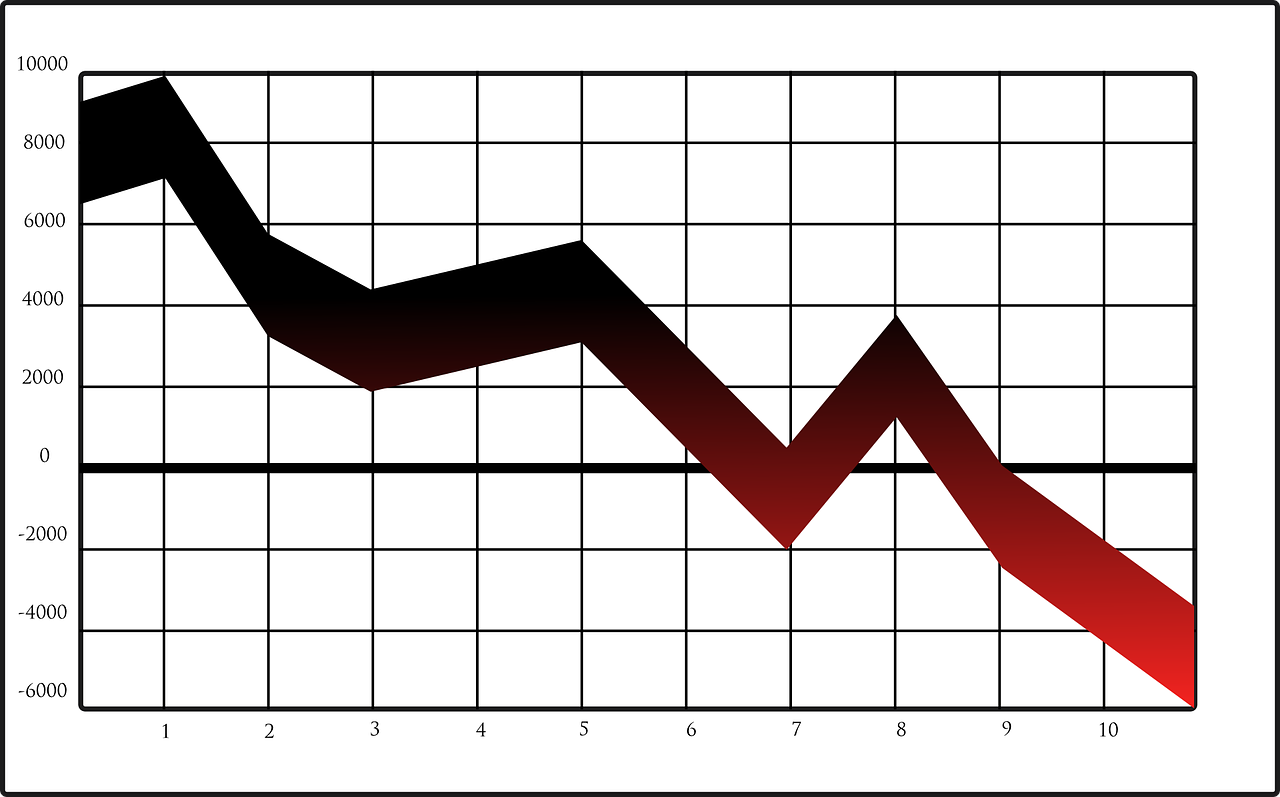

What does one do in this market crash? how to deal with a market crash? It is really time to look and say, this is a crisis. And in crisis, strange things could happen. In the year 2008 crisis had happened and the market has collapsed by more than 50%. While in 2020, we are down by 30% so far.

Right now we are dealing with the man-made crisis which is crude oil and medical crisis which is Coronavirus. With these two, things could go worst than the year 2008.

How to Deal With Market Crash [2020]

According to me, this is not a coronavirus problem, this is a problem of fear of coronavirus. The panic situation due to coronavirus is spread across the globe. All the world economy is under pressure and people are selling like stocks never before.

The solution to coronavirus is the shutdown of the economy, which has never happened in history until now. This is for the first time it is happening that the world economy is at a halt. I don’t think anybody in the world has seen this type of scenario where the global economy is halted down.

But the good thing is that the underlying value of the companies has not changed. The underlying value of the stock price which was one month before is the same as today. This is a completely uncharted and first-time phenomenon in the history of the world.

Also Read: CoronaVirus Market Crash

So in such a situation, how does one conclude what is right or what is wrong? What is the fundamental bottom of the market? Well, it depends on the stock you pick. The underlying value of the stocks will remain the same. It is just a matter of time.

Under this situation, I don’t think the valuation of the fundamentally strong company is going to change. So under this situation, an investor must understand and asses the risk appetite and then only invest in the market.

During this scenario, the investment in the market would be done in small tranches rather than going at one go. If you are planning to invest ₹ 1 lakh, then invest ₹ 20000 at each market fall.

Don’t stop SIP

SIP is the best way to average out your buying and hence one should not stop the SIP under this panic situation. Please continue with your SIPs as it will average out your earlier buying and when the market will bounce back, the gain will be much higher.

All the bluechip companies earning power has not changed drastically. Yes, they have been slow down due to the economic slowdown, but they will be back on track one this coronavirus things get settled down.

Its only a price change and not value change

What is changed in the fundamentally strong company is the price of the stock only. Their underlying value is not changed. They still have the potential of earning you good returns once the market bounces back.

How can the virus have an impact on the business potential of the company? It is just a fear that is dragging the price down. There is a panic situation in the market and everybody wants to save their money.

Believe me, your money is safe in the longer run. The market will surely bounce back. It is a crisis of price change and not the value change. In the short term, the price changes are very volatile due to the fear in the market.

It is not only India that is getting impacted, but the worldwide markets are also down drastically. I don’t think the value has changed so much and will not going to change in the months to come.

There is purchasing power in the system to deal with the market crash

Due to the fear in the market, nobody is daring to buy even good stocks at a lower price. There are many fundamentally strong companies available at the price lower than the year 2008 PEs. But due to the fear factor, they are not buying. It is not that the buying power is not there in the market.

That’s the reason I am advising the investors not to stop their SIPs at this moment and lose faith in the market.

Anybody that thinks they did bottom fishing at 9000 nifty levels is scared at 8500 levels. So there is a fear in the atmosphere which is not letting down the investor invest in even good companies like HDFC Bank.

Short Selling is the Culprit

In the bleeding market when investors are losing money, there are few smart people who have made tons of money through short selling. Due to the fear in the market, few investors have started selling the stocks. The smart people have taken advantage of this fear and short the stock in the market. So there is enough pressure and panic in the market that it went down by 8-10% a day.

On 13th March, when the stock market was held for 45 minutes due to a lower circuit breaker, SEBI has deleted all the pending orders on the exchange. When the market re-opens at 10 a.m. there was a huge buying we saw that day. All those canceled orders are mostly from the few smart people who know the art of making tons of money in the falling market.

ETF Sold off

All FIIs invest money through ETF in the Indian market. All fundamentally strong companies are sold in the ETFs by the FII. When FII starts selling they don’t see price. They simply set the target of let’s say 10 million dollars for the day. And sell all the stocks at whatever price they get until they complete 10 million dollars.

Remember, They also bought without looking at the price.

This is another big reason for sharp falls every day. Markets are emotional, they follow the sentiments and thus the cut is getting even deeper and deeper each day.

Conclusion:

Be fearful when everyone is greedy, and be greedy when everyone is fearful.

– Warrren Buffett

[jetpack_subscription_form]