The central bank i.e. RBI has extended the date for tokenise debit card, credit card to 30th September 2022. However, the Reserve Bank of India has been notifying the users about completing the process as soon as possible. There are various campaigns run by the RBI to promote tokenization of Debit card, credit card.

What is Tokenise Debit Card Credit Card?

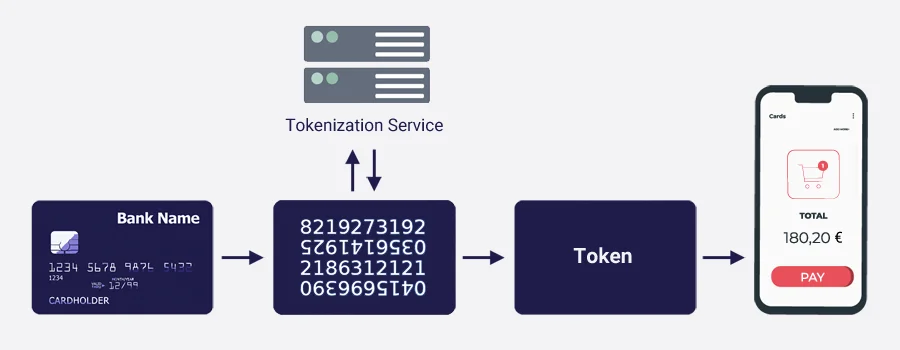

As per the RBI, “Tokenisation is the replacement of your actual card details with an alternate code called “token”. The token will be a unique combination of card number and device from which the request has been made. It is advisable to tokenise your card while making online payment to prevent fraudulent transactions. The registration of tokenization is only done with the user consent and through Additional Factor Authentication (AFA).

The recent tweet from RBI is showing a six steps guideline for tokenise debit card, credit card. It is not mandatory to tokenise your debit card, credit card but it is advisable to tokenise your card to protect it from the online fraud.

How to Tokenise Debit card, Credit card?

Here is the step-by-step guideline to tokenise debit card & credit card.

- Go to any of the e-commerce website, select the item you wish to buy.

- Go to the check out page and start the payment process.

- Enter your debit card or credit card details on the payment page and process further.

- Click on the option “Secure your card” OR “Save your card as per RBI guideline”.

- You will receive the OTP, enter that OTP on the payment page.

- Your unique token will be generated and saved instead of your actual debit or credit card number.

- On your next transaction on the same website, you will see the last 4 digit of your debit or credit card as the same has been tokenised.

FAQs : Tokenise Cards

No, it is optional. However, it is advisable to tokenise your card to prevent fraudulent transaction.

No, the facility is completely free of cost. No bank or the merchant can charge anything for this facility.

No, the facility is available only for domestic transactions.

Yes, the user will be given a choice of amount as a limit for tokenization.

Yes, you can add any number of cards on the website for tokenization.

Well in that case, you will have to enter the new card details on the website and delete the expired one.

Conclusion:

This is a good step by RBI for preventing online fraudulent transactions and safe guard card details online. I have done my credit card tokenise on Amazon’s website. I will also keep on adding other sites as and when I will use them. Have you done any tokenization? if yes, please share your experience in the comment box below.

Please share this article to your friends and family.