In Budget 2020, the finance minister has introduced a new income tax structure along with the existing tax structure. The new tax structure is optional so the taxpayer has now the option to choose between existing and new tax structure. How to do Income Tax Slabs Calculation FY 2020-21? Which Tax Structure to Select? So here is the answer. I will also tell you that which tax structure is suitable to you based on your income and deduction you claim.

As per budget 2020, the new tax structure comes with the restriction on the deductions you claim under the existing tax structure. So as an individual taxpayer if you choose the new tax structure with reduced tax rates then you need to let go of all the deductions which you might be claiming till now under the existing tax structure.

The good thing is that the new tax structure is completely optional. You can still continue with the old tax structure if it’s more beneficial to you. Now let’s check when to choose which tax structure.

Before we move ahead let’s have a look at the overall tax statistics for FY 2018-19. A total of 5.8 crore people has filed income tax returns. Out of that, around 9% (48 lakhs) people have claimed deductions higher than 2 lakhs. 3.77 lakhs people have claimed deductions of higher than 4 lakhs.

In this article, we will try to understand the deductions that we want to claim and its tax impact.

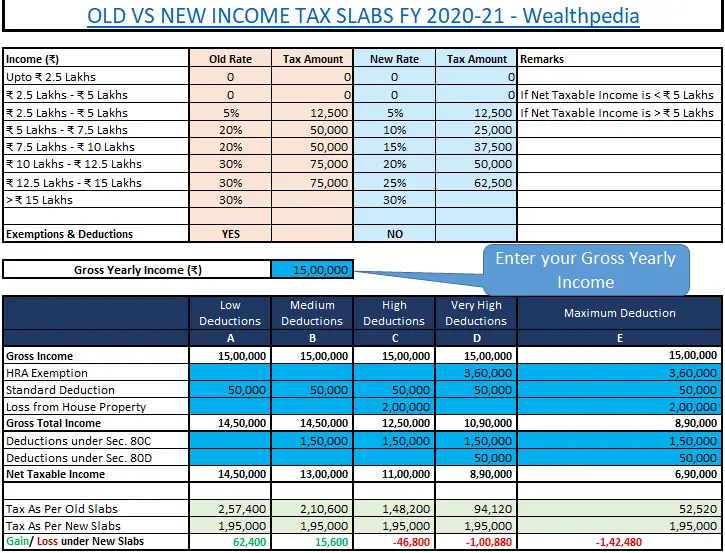

Income Tax Slabs Calculation FY 2020-21

Let’s compare the old vs new Income Tax Calculation FY 2020-21.

As you can see there is no tax payable up to an income of ₹ 2.5 lakhs under old and new tax structure. There is a confusion in 2.5 lakhs to 5 lakhs income slab. The payable tax on income up to ₹. 5 lakhs becomes nil if your net taxable income is less than 5 lakhs.

Net taxable income = Gross income - Deductions you have claimed

If your net taxable income crosses 5 lakhs then you have to pay a 5% tax on the net taxable income. For example, your net taxable income is ₹ 6 lakhs so on the extra 1 lakh you are eligible to pay 5% income tax. For the income slab of 5 lakhs to 10 lakhs, earlier 20% tax was payable but in the new tas structure, it has been reduced to 15%. In the same way, there is a 30% tax rate on income above 10 lakhs and up to ₹. 15 lakhs, which has been reduced to 25% in the new tax slabs.

List of Tax Deductions and Exemption

The main difference between old and new tax slabs is the exemptions and deductions you are claiming. This is going to be the game-changer for you. So it is very important that you do proper homework before you decide to choose the tax structure.

Firstly, we will talk about which tax deduction and exemption you need to forgo in case you opt for a new tax structure with reducing the tax rate. Secondly, we will take a different scenario and do income tax calculations for FY 2020-21 to know which tax structure to select?

Deduction Under Section 80C

This one is the most common and widely used deduction section in income tax. It allows a tax deduction of ₹ 1.5 lakhs under section 80C. Below are the mainly used instruments for claiming benefit under section 80C.

- Provident Fund

- Public Provident Fund

- Life Insurance Premium

- NPS

- Tuition fees

- ELSS

- Home loan (capital portion)

Deduction Under Section 80D

This section covers the medical insurance premium and preventive health checkup amount you paid. The upper limit for this section is ₹ 25000/year.

HRA

HRA (House Rent Allowance) is paid to the salaried people as a part of their salary. HRA (House Rent Allowance) is the minimum of the following amounts:

- Actual HRA component of salary

- 50% of basic salary if he resides in Delhi, Chennai, Kolkata, or Mumbai; 40% if his residence is in any other city

- Actual rent paid less 10% of basic salary

The below table shows the tax deductions and exemptions you can claim under the old tax structure but are not allowed in the new tax structure.

| Tax Deductions and Exemption | Amount | Old | New |

| Standard Deduction | 50000 | Yes | No |

| Section 80C | 150000 | Yes | No |

| Section 80D | 50000 | Yes | No |

| HRA (House Rent Allowance) | Actual | Yes | No |

| LTA (Leave Travel Allowance) | 30000 | Yes | No |

| Section 80TTA (Interest Income) | 10000 | Yes | No |

| Section 80DDB (Disability Benefit) | 40000 | Yes | No |

| Section 80E (Interest on Edu. loan) | Actual | Yes | No |

| Section 80G (Donation) | Actual | Yes | No |

| Section 24 (Home loan Interest) | 200000 | Yes | No |

In short, all deduction applicable under chapter VIA like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc) will not be claimable for those who are opting for the new tax regime.

Old vs New Tax Structure Comparision

Now let’s have a look at the different scenarios with different deductions. For this example, I have taken 5 scenarios where different combinations of the deductions are considered to check the effect of the new income tax structure.

For this calculation, I have considered the gross income as ₹ 15 lakhs. You can change and update your own income on the sheet. After checking different deductions under the different slab, one thing is coming out is the new tax structure is beneficial only if your taxable income is 15 lakhs and you are not claiming any deductions.

The structure is designed in a way that if you don’t claim different deduction then you will save more tax up to an income of Rs. 15 lakhs.

I have designed and uploaded Income Tax Calculation FY 2020-21 in an excel format. You will have to enter the gross income and deductions which you want to claim.

A step-by-step process for using income tax slabs calculation FY 2020-21

- Download the income tax calculator from this link.

- Enter your gross yearly income in the blue box

- There are 5 different scenarios (Scenario A to E) of various deductions

- Enter the deduction amount you wish to get as an exemption

- The tax amount will automatically get calculated

- The difference amount in the last row will tell you whether it is beneficial for you or not

Let’s understand the same with the example. Suppose Amit is having a gross salary of Rs. 15 lakhs/year. He wants to check which tax structure is beneficial to him. Below is the list of the components he claims as deductions.

- Standard deduction

- Deductions under Sec. 80C

His taxable income would come to Rs. 13 lakhs (15 lakhs – 1.5 lakhs 80C – 50 thousand of standard deduction)

Now as per the old income tax structure, Rs. 210600/- is the tax amount he has to pay. On the other side, with the new tax structure, his tax liability comes to Rs. 195000/-.

So he can save Rs. 15600/- on tax if he chooses to go for a new tax structure. In this scenario, the new tax structure is beneficial.

Now let’s assume that Amit has taken a home loan for Rs. 30 lakhs. He is not eligible for claiming Rs. 200000 as a deduction under section 24 of the Income-tax Act.

With these changes, his taxable income comes down to Rs. 11 lakhs. So the tax payable as per the old structure would be Rs. 148200/-. As against this as per the new tax structure, the tax amount would be Rs. 195000/-

In this scenario, the new tax structure is not viable for Amit as he would have to pay 46800/- more as tax.

Also Read: How to file Income Tax Return?

Income tax slabs calculation fy 2020-21 – Is it good or bad?

Frankly speaking, the new tax structure is good as the taxpayer will have the option to choose between two different tax structures based on his/her financial situation.

As I mentioned above, the person who is claiming several deductions like 80C, 80D, home loan, HRA will not be benefited from the new tax structure. Secondly, the taxpayer can switch over between old and nex tax structures every year. So it is more flexible for the individual where the financial situations may change in the future.

The tax benefit is the prime driver for an individual to make an investment decision in India. The individual taxpayer with the income of say around 10-15 lakhs will tend to spend more rather than saving/investment.

FAQs – Income Tax slabs Calculation FY 2020-21

The tax structure is as below for individual taxpayers.

Yes, You are free to change the tax structure every year. For the salaried person, it is usually in the first quarter of the new financial year because they have to provide investment provisions to their employer.

Yes, health and education cess are applicable to the new tax structure.

That depends on your income and deductions you claim. I have prepared a tax calculator wherein there are different scenarios. I would request you to please download the excel file and give basic inputs to have an idea about which tax structure is suitable for you.

Net taxable income = Gross income – Deductions you have claimed

Yes, as per the budget proposals, a taxpayer can still claim a tax rebate of Rs 12,500 if his/her net taxable income does not exceed Rs 5 lakh in a financial year.

Download Income Tax slabs Calculator FY 2020-21

[jetpack_subscription_form]