Every senior citizen wanted to live a peaceful life after he or she gets retired, but the same can only be possible when you have solid planning for your retirement. There are many options for retirement funds and pension fund is available in the market to choose from. There is one such option for retirement planning through a mutual fund which can help senior citizens to live a tension-free life. In this article, I will discuss how to plan for your retirement through mutual fund investment.

How should you do retirement planning?

There are two stages of retirement planning. 1) Accumulation and 2) Distribution.

Accumulation means investing gradually and regularly for retirement planning. When you get to retire, and you need regular income, you can withdraw a particular amount every month. This is the distribution phase.

There are various types of mutual funds that can be purchased based on your needs. The same will be helpful in your retirement planning. Now, let’s understand these 2 phases in detail.

Accumulation Phase

It is important that you will get a good and secure return on your investment at all times. Retirement planning is solely based on the assumption of the return on your investment and projected inflation. For any retirement portfolio, there must be an asset like equity, debt, real estate, gold etc. This asset mix will help the investor to have a balanced portfolio that can withhold any weather.

Retirement planning is long-term planning so that you can take a bit of risk to gain higher returns. If you are planning your retirement at a young age, then you will get a higher return as you have 2 advantages, 1) longer time for retirement and 2) Higher risk appetite. If you invest in the equity market for the long term, then you will get higher returns as compared to other investment options.

If you invest in a fixed deposit or gold, you will not get higher returns and you will miss the opportunity to earn higher returns. Inflation will increase with time, fixed deposits will not yield higher returns than inflation. So that will eat up your returns earned on the fixed deposit. Under such a situation, you will not be able to reach your financial goal with the negative returns on your investment.

To avoid this situation, the majority of the investment should be in equity mutual funds that will earn you higher returns and help you to achieve your financial goal at retirement age.

Furthermore, you can check the fund investment in which company like large cap, mid cap, debt etc. and decide your fund to get maximum return out of the fund. You should have a balance of large-cap, mid-cap and debt funds in your portfolio.

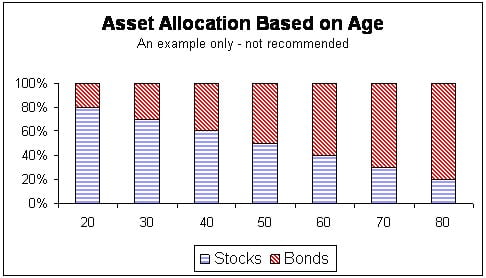

You need to shift your asset allocation from equity to debt fund as you grow old. This shift will ensure portfolio balance and saves you from the market’s ups and downs.

There is a simple formula on what portion of your investment should go into an equity mutual fund. The formula is as below.

100 – Your current age

This formula is straightforward and makes sense.

Distribution Phase

This is the second stage of retirement planning. This is an equally important stage as you will now have to withdraw the amount gradually as per your need. The main thing you need to maintain is a discipline in withdrawing the amount from the retirement corpus. At this stage your risk-taking capacity is very minimal, hence you need to invest your money in the investment avenues that will give you stable and secure returns like fixed deposits, post office saving schemes etc.

what should be the ideal investment portfolio for retirement planning? It’s right here, just have a look at the below image to have an idea of the investment portion at different ages.

Stocks = equity stocks/mutual funds

Bonds = Debt funds/fixed deposite etc.

Conclusion: Retirement Planning

Retirement planning at an early age will help you enjoy your retirement life with peace of mind. This is one of the very crucial planning that one must do at a younger age. Do it even at the later stage of your life, don’t ignore this planning at any cost.