Big MF is nothing but the Mutual Fund in India. There is an increasing trend in India of people investing in mutual funds. I know, most of you already know what is a mutual fund and how to invest in it. But through this article, I will show you where Indians are investing in mutual funds.

What is a big MF? (Big Mutual Fund)

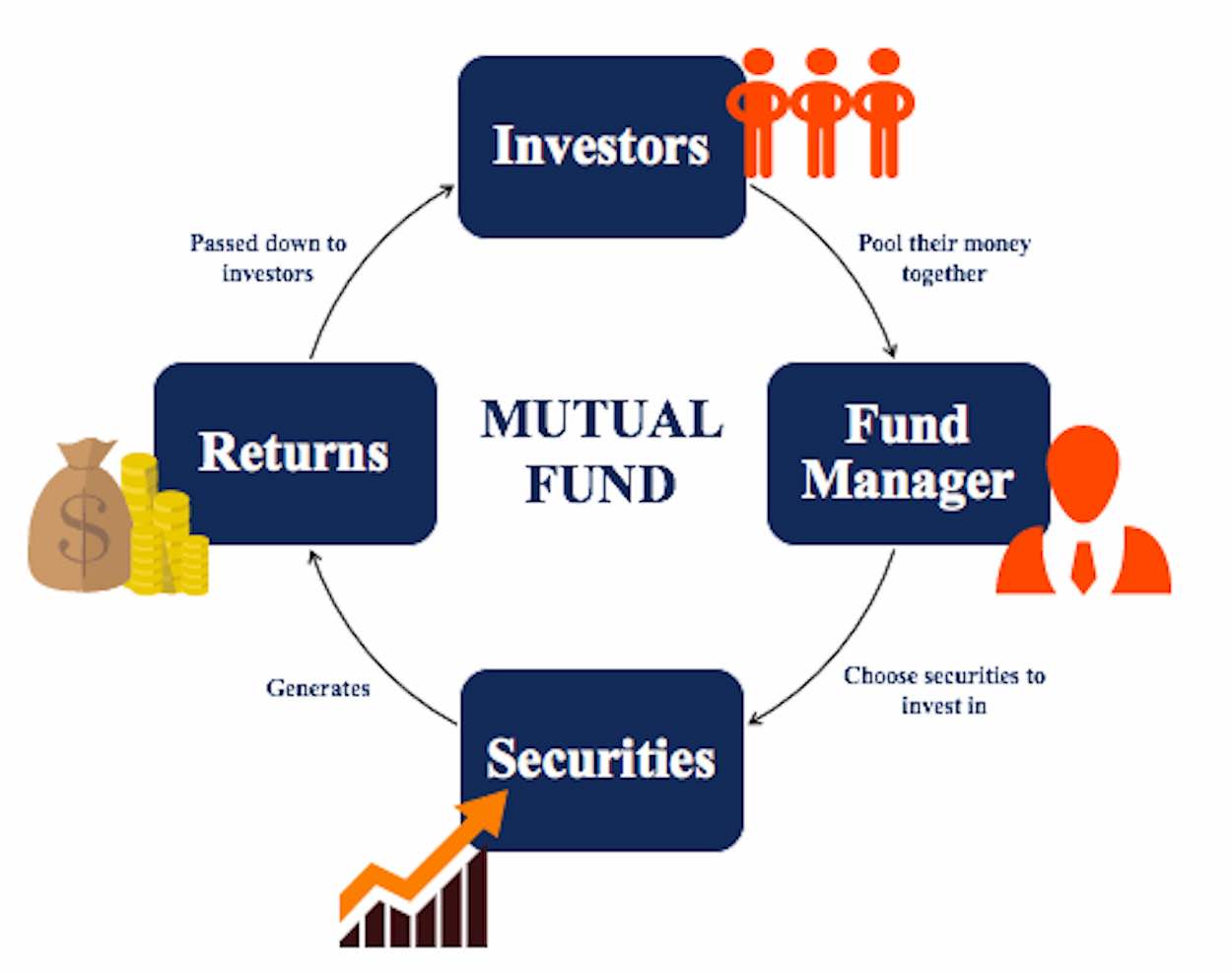

A mutual fund is an investment avenue made up of a pool of money that is collected from many investors like you and me to invest in different securities like stocks, bonds, money market, and other assets.

Mutual funds are operated by professional managers. They are called the fund managers. so typically, these fund managers accumulate the money from the retail investors and invest them into different investment avenues. Of course, the fund manager and AMC (Asset Management Company) will take out their cut which is called the expense ratio.

Every mutual fund scheme has an investment objective written down in its prospectus. This objective is nothing but the investment strategy designed for that particular scheme. The fund manager must stick to these objectives while allocating funds in the market.

A mutual fund is like crowdfunding for investment. So each stakeholder, therefore, participates proportionally in both gain and loss.

What are the Types of Mutual Funds in India?

The Mutual Fund schemes in India are broadly classified in the below categories.

Equity Mutual Fund Scheme: SEBI has decided on 10 Mutual Fund categories under the Equity Mutual Fund segment. The scheme could be large-cap, mid-cap & small-cap. There is a separate definition for them.

- Large Cap: Top 100 companies in terms of market capitalization

- Mid Cap: 101 to 250th companies in terms of market capitalization

- Small Cap: Remaining companies

Debt Mutual Fund Scheme: These type of Mutual Fund schemes invests in fixed-income Government securities like bonds, treasury bills, liquid funds, gilt funds etc. The investment period and return are fixed for these set of schemes. So these schemes are appropriate for conservative investors who want fixed return and whose risk appetite is low.

Hybrid Mutual Fund Scheme: Hybrid as the name suggest, these are the schemes with the combination of equity and debt funds. The portion of equity and debt is varies for different scheme based on the scheme objectives. Mostly they are 50-50 or 65-35 between equity and debt funds.

They are also called a balanced funds as they provide balance between risk and return to the investors.

Size of Mutual Fund Industry in India

How big MF industry is? To answer this question, let’s crunch some numbers.

- The size of the Indian Mutual Fund Industry is 32.30 trillion as of Feb 2021.

- There are a total of 1729 mutual fund schemes active

- There are 9,43,35,478 accounts in the mutual fund industry as of December 2020, of which 90.1% is accounted for by retail investors.

- There were:

- 8,49,87,616 Retail investor accounts (90.1%)

- 85,59,664 HNI accounts

- 7,88,198 Institutional investor accounts

- Most of the investors are investing in Equity schemes, which is comprises 69.2% followed by Hybrid 9.8% & debt schemes 6.1%.

- The average ticket size of the mutual fund portfolio is Rs. 3.29 Lakhs

- Retail investor’s average account size is Rs. 69185

- 48.2% of the Equity schemes stay invested for more than 2 years.

Where do Retail investors invest in Mutual Fund?

Now above is just the numbers, so let’s understand where the retail investors like you and me are investing.

Individual investors are inclined towards equity mutual funds. Most people are investing in equity funds because of the anticipation of higher returns. The investment portion in an equity fund is as high as 69% of the total average portfolio size on retail investors.

As you can see in the above chart, retail investors are investing in equity funds for higher returns. While the Institutions (Big companies) are investing in different schemes. Here you can see the variance in the individual and Institution’s portfolio.

Now, this is why the retail investors are not sticking to the MF portfolio when there is a bear trend in the market. During the bear phase, retail investor’s portfolio starts bleeding and that why they start redemption from the portfolio. On the other hand, the portfolio of the institution will not go as low as retail investors due to the balanced investment approach.

Why Retail Investor Should Invest Through SIP

The retail and first-time investors in Mutual Fund must start their journey through the SIP (Systematic Investment Plan). SIP offers great flexibility to the investors in terms of the investment amount, type of investment, investment horizon, risk appetite, tax benefit, etc.

The other reason why you should invest through SIP is that you and I have limited knowledge about the financial markets. While the people who are managing Mutual Fund are experts in their domain. It is their daily job and they are connected to the markets. So you should invest through SIP and leave the decision on the professionals.

Here are the benefits of investing through SIP

- Flexibility on the investment amount, duration

- Managed by professionals

- Minimum investment amount to start like Rs. 500 or Rs. 1000

- Any time exit option

- Tweak your SIP as you want

Conclusion:

Mutual Fund is a great investment product that is completely flexible as per the investor’s needs. I personally have invested in Mutual Fund’s various schemes. My returns are as per my expectation. I have invested in L&T Large Cap Fund. Why L&T? Because it is one of the well-reputed Mutual Fund companies in India. It is a fully owned subsidiary of L&T Finance Holding Limited and a part of L&T Group. L&T Mutual Fund always emphasizes delivering superior and risk-adjusted returns.

Disclaimer: This information is for general information only and does not have regard to the particular needs of any specific person who may receive this information. L&T Investment Management Limited, the asset management company of L&T Mutual Fund or any of its associates; does not guarantee/indicate any returns/and shall not be held liable for any loss, expenses, charges incurred by the recipient. The recipient should consult their legal, tax and financial advisors before investing. The recipient of this information should understand that statements made herein regarding future prospects may not be realized or achieved.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

All Data reference: AMFI website

Size Of Mutual Fund Industry:

https://www.amfiindia.com/indian-mutual

https://www.amfiindia.com/Themes/Theme1/downloads/home/FolioandTicketSize.pdf

Graph & chart: https://www.amfiindia.com/Themes/Theme1/downloads/home/industry-trends.pdf