Financial literacy in India is an essential aspect of every individual’s life. It refers to the knowledge, skills, and attitudes necessary to make informed and effective decisions regarding money management. It enables individuals to understand financial concepts, such as budgeting, saving, investing, and borrowing, and use them to manage their finances effectively.

In India, financial literacy is a crucial issue that needs to be addressed. Despite India’s rapidly growing economy, financial literacy remains low among the population. According to a survey conducted by the National Institute of Securities Markets (NISM) in 2019, only 24% of Indian adults were financially literate. This low level of financial literacy is a cause for concern, as it can lead to poor financial decisions, which can have long-term consequences for individuals and the economy as a whole.

There are several reasons for the low level of financial literacy in India. One of the primary reasons is the lack of formal education on financial literacy. The Indian education system does not focus on financial literacy as a subject in schools, colleges, and universities. As a result, individuals are left to learn about financial concepts on their own, which can be challenging, especially for those with limited access to resources such as the internet or financial advisors.

Another reason for the low level of financial literacy in India is the lack of awareness about financial products and services. Many individuals are not aware of the various financial products and services available to them, such as bank accounts, credit cards, loans, and insurance. This lack of awareness can lead to poor financial decisions, such as taking out high-interest loans or investing in unsuitable financial products.

To improve financial literacy in India, several initiatives have been launched by the government and various organizations. One such initiative is the National Strategy for Financial Education (NSFE), which was launched by the Reserve Bank of India (RBI) in 2012. The NSFE aims to create awareness about financial concepts and products among the population and promote financial inclusion.

Under the NSFE, various programs have been launched, such as financial literacy camps, workshops, and seminars, to educate individuals on financial literacy. The RBI has also partnered with various organizations, such as NGOs and banks, to increase financial literacy across the country.

Apart from the government initiatives, several private organizations have also taken up the cause of promoting financial literacy in India. For instance, the Securities and Exchange Board of India (SEBI) has launched the “Mutual Funds Sahi Hai” campaign to create awareness about mutual funds and encourage individuals to invest in them.

Another private initiative is the “Jagruti” program launched by HDFC Bank, which aims to educate individuals on financial literacy through workshops and training sessions. The program focuses on various financial concepts such as budgeting, saving, investing, and borrowing.

Apart from these initiatives, individuals can also take several steps to improve their financial literacy. One of the essential steps is to start with the basics, such as understanding the importance of budgeting and saving. Individuals can also seek the help of financial advisors or attend financial literacy workshops to gain a better understanding of financial concepts.

In conclusion, financial literacy is an essential aspect of every individual’s life. In India, the low level of financial literacy is a cause for concern, as it can lead to poor financial decisions and have long-term consequences for individuals and the economy as a whole. To improve financial literacy in India, various government and private initiatives have been launched, and individuals can also take steps to improve their financial literacy. By promoting financial literacy, we can ensure that individuals can make informed and effective financial decisions, leading to a better financial future for themselves and the country.

Government initiatives towards financial literacy in India

The Indian Government has launched several initiatives towards improving financial literacy among the population. These initiatives aim to create awareness about financial concepts and products and promote financial inclusion. In this article, we will discuss some of the government initiatives towards financial literacy in India.

- National Strategy for Financial Education (NSFE)

The Reserve Bank of India (RBI) launched the National Strategy for Financial Education (NSFE) in 2012. The NSFE aims to create awareness about financial concepts and products among the population and promote financial inclusion. The NSFE is a comprehensive framework that involves various stakeholders, such as policymakers, regulators, educators, and financial service providers.

Under the NSFE, the RBI has launched various programs such as financial literacy camps, workshops, and seminars to educate individuals on financial literacy. The RBI has also partnered with various organizations, such as NGOs and banks, to increase financial literacy across the country.

- Pradhan Mantri Jan Dhan Yojana (PMJDY)

The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched in 2014 by the Indian government to promote financial inclusion among the population. The PMJDY aims to provide every household in India with a bank account, debit card, and access to financial services such as insurance and credit.

Under the PMJDY, the government has also launched various financial literacy programs to educate individuals on the use of bank accounts, digital transactions, and other financial products.

- Digital India

The Digital India initiative was launched in 2015 by the Indian government to promote the use of digital technology in various sectors, including finance. The initiative aims to create a digital infrastructure that can enable the delivery of financial services to individuals in remote areas.

Under the Digital India initiative, the government has launched various programs such as Digital Saksharta Abhiyan (DISHA) to educate individuals on digital literacy and the use of digital financial products and services.

- Atal Pension Yojana (APY)

The Atal Pension Yojana (APY) was launched in 2015 by the Indian government to provide a pension to workers in the unorganized sector. The APY aims to promote the culture of savings and help individuals build a corpus for their retirement.

Under the APY, the government has also launched various financial literacy programs to educate individuals on the importance of retirement planning and the use of pension schemes.

- Swavalamban Yojana

The Swavalamban Yojana was launched in 2010 by the Indian government to promote the culture of savings among the unorganized sector workers. The scheme aims to encourage individuals to save for their retirement by providing them with a matching contribution from the government.

Under the Swavalamban Yojana, the government has also launched various financial literacy programs to educate individuals on the importance of savings and the use of financial products such as pension schemes.

In conclusion, the Indian government has launched several initiatives towards improving financial literacy among the population. These initiatives aim to create awareness about financial concepts and products and promote financial inclusion. By promoting financial literacy, the government can ensure that individuals can make informed and effective financial decisions, leading to a better financial future for themselves and the country.

Financial Literacy trend in India

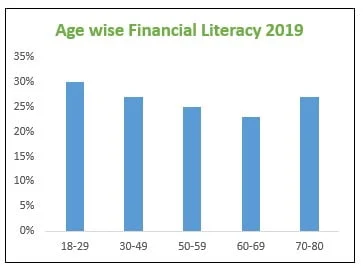

According to the National Financial Literacy Assessment Test (NCFE) conducted by the National Institute of Securities Markets (NISM) in 2020, the financial literacy rate among Indian adults was 29.8%. The study found that the overall financial literacy rate had improved from 28.4% in 2017.

The NCFE report also highlighted that the financial literacy rate was higher among men (32.2%) compared to women (27.3%). Additionally, the study found that the financial literacy rate was higher among individuals with higher education levels and income levels.

In terms of financial literacy trends, the NCFE report suggested that there was a positive trend in financial literacy among Indian adults. However, there was still a significant gap in financial literacy rates among different segments of the population.

Another study conducted by the Standard & Poor’s (S&P) Global Financial Literacy Survey in 2018 ranked India 24th out of 28 countries in terms of financial literacy. The study found that only 24% of Indian adults were financially literate, which was lower than the global average of 33%.

In conclusion, financial literacy rates in India have shown some improvement in recent years. However, there is still a significant gap in financial literacy rates among different segments of the population. More efforts are needed to improve financial literacy rates, especially among women and individuals with lower education and income levels.

Importance of Financial Literacy in India

Financial literacy is the knowledge and skills required to manage personal finances effectively. It includes the ability to understand financial concepts, budgeting, saving, investing, and using financial products and services. In India, financial literacy is essential for individuals to make informed financial decisions, achieve financial goals, and contribute to the economic growth of the country. In this article, we will discuss the importance of financial literacy in India.

- Encourages savings and investments

One of the significant benefits of financial literacy is that it encourages individuals to save and invest their money wisely. Financially literate individuals can understand the importance of saving and investing and can make informed decisions about where to invest their money. With the right knowledge, individuals can invest their money in various financial instruments such as mutual funds, stocks, and bonds, which can help them achieve their financial goals and build wealth.

- Promotes financial inclusion

Financial literacy also promotes financial inclusion by helping individuals access financial products and services. In India, there are still many people who are unbanked or underbanked, and financial illiteracy is one of the major reasons for this. Financially literate individuals can understand the benefits of having a bank account, using digital transactions, and accessing financial products such as loans and insurance. This, in turn, can help them participate in the formal financial system and improve their financial well-being.

- Helps to manage debt

Managing debt is an essential aspect of personal finance, and financial literacy can help individuals manage their debt effectively. Financially literate individuals can understand the different types of debt, such as credit card debt, personal loans, and home loans, and can make informed decisions about taking on debt. They can also manage their debt effectively by paying off high-interest debt first, creating a budget, and avoiding unnecessary debt.

- Prevents financial fraud and scams

Financial literacy can also protect individuals from financial fraud and scams. In India, there are many instances of financial fraud and scams, and individuals who lack financial literacy are at a higher risk of falling prey to these scams. Financially literate individuals can understand the signs of financial fraud and scams and can take measures to protect themselves.

- Promotes economic growth

Finally, financial literacy can contribute to the economic growth of the country. When individuals are financially literate, they can make informed financial decisions, which can lead to better investment decisions, higher savings rates, and increased economic activity. This, in turn, can contribute to the overall economic growth of the country.

Financial Literacy Books

Financial literacy is an essential aspect of personal finance, and reading books on this topic can be a great way to improve one’s financial knowledge and skills. We will discuss some of the best financial literacy books that individuals in India can read.

Rich Dad Poor Dad by Robert Kiyosaki

Rich Dad Poor Dad is a classic book on personal finance that has sold millions of copies worldwide. The book is written in a storytelling format and follows the author’s journey of learning about personal finance from his “rich dad” and his “poor dad.” The book teaches readers about the importance of financial literacy, the difference between assets and liabilities, and how to build wealth through investments.

The Richest Man in Babylon by George S. Clason

The Richest Man in Babylon is another classic book on personal finance that has been popular for decades. The book is written in the form of parables set in ancient Babylon and teaches readers about the principles of wealth building such as living below your means, saving, and investing. The book is easy to read and provides practical advice that can be applied in today’s world.

The Total Money Makeover by Dave Ramsey

The Total Money Makeover is a comprehensive book on personal finance that provides readers with a step-by-step plan for getting out of debt, building an emergency fund, and investing for the future. The book also covers topics such as budgeting, saving, and avoiding financial pitfalls. The author, Dave Ramsey, is a well-known financial guru and radio host, and his advice has helped many people improve their financial situation.

The Intelligent Investor by Benjamin Graham

The Intelligent Investor is a classic book on investing that has been popular for decades. The book teaches readers about the principles of value investing, which involves buying undervalued stocks and holding them for the long term. The book provides practical advice on how to analyze stocks, diversify a portfolio, and manage risk. The author, Benjamin Graham, is considered one of the greatest investors of all time and is known as the “father of value investing.”

Your Money or Your Life by Vicki Robin and Joe Dominguez

Your Money or Your Life is a book on personal finance that teaches readers how to achieve financial independence and retire early. The book emphasizes the importance of living below your means, tracking your expenses, and investing for the future. The book also covers topics such as reducing debt, increasing income, and achieving a work-life balance. The book has been popular for decades and has helped many people improve their financial situation and achieve financial freedom.

In conclusion, reading books on financial literacy can be a great way to improve one’s financial knowledge and skills. The books mentioned above are just a few of the many great books on personal finance available to individuals in India. By reading these books and applying the principles discussed, individuals can take control of their finances and achieve their financial goals.

Financial Literacy Quotes

Here are some of the famous quotes on financial literacy.

- “An investment in knowledge pays the best interest.” – Benjamin Franklin

- “The only way to permanently change the temperature in the room is to reset the thermostat. In the same way, the only way to change your level of financial success ‘permanently’ is to reset your financial thermostat. But it is your choice whether you choose to change.” – T. Harv Eker

- “Financial freedom is available to those who learn about it and work for it.” – Robert Kiyosaki

- “Don’t let the fear of losing be greater than the excitement of winning.” – Robert Kiyosaki

- “The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.” – T.T. Munger

- “If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffett

- “Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” – Dave Ramsey

- “The rich invest in time, the poor invest in money.” – Warren Buffett

- “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” – Robert Kiyosaki

- “Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver.” – Ayn Rand.

Financial Literacy Courses

A financial literacy course is a program designed to educate individuals about various aspects of personal finance, including budgeting, saving, investing, and managing debt. Such courses are intended to provide individuals with the knowledge and skills needed to make informed financial decisions and manage their finances effectively.

Many financial literacy courses are available in India, both online and offline, and can be completed by individuals of all ages and backgrounds. These courses are typically structured in a series of modules that cover various topics related to personal finance. Some of the topics that may be covered in a financial literacy course include:

- Budgeting: This module teaches individuals how to create and maintain a budget, track expenses, and manage their income effectively.

- Saving: This module covers topics such as the importance of saving, different types of savings accounts, and strategies for saving money.

- Investing: This module covers the basics of investing, including the different types of investment vehicles and strategies for building a diversified portfolio.

- Debt management: This module teaches individuals how to manage their debt effectively, including strategies for paying off debt and avoiding debt traps.

- Retirement planning: This module covers the basics of retirement planning, including the importance of starting early, different types of retirement plans, and strategies for building a retirement portfolio.

- Financial planning: This module covers the basics of financial planning, including setting financial goals, creating a financial plan, and monitoring progress towards those goals.

Some financial literacy courses may also offer certification upon completion, which can be useful for individuals seeking employment in the financial industry or looking to enhance their professional credentials.

Overall, taking a financial literacy course can be a great way for individuals to improve their financial knowledge and skills, and make informed decisions about their finances. With the increasing importance of financial literacy in today’s world, such courses are becoming more widely available and accessible to people from all walks of life.

Conclusion

In conclusion, financial literacy in India is essential for individuals to make informed decisions about their personal finances. With the ever-increasing complexity of the financial world, it has become more important than ever to understand the basics of personal finance, including budgeting, saving, investing, and managing debt.

India has recognized the importance of financial literacy, and the government and various organizations have taken several initiatives to promote financial literacy among the masses. The trend of financial literacy in India is increasing, with more individuals seeking financial education to improve their financial knowledge and make informed decisions.

In addition to government initiatives, there are several financial literacy books, resources, and courses available to individuals to enhance their financial literacy. Taking a financial literacy course is an excellent way for individuals to learn about various aspects of personal finance and develop the skills needed to manage their finances effectively.

In conclusion, financial literacy is critical to achieving financial stability and success in life. By improving their financial knowledge and skills, individuals can make informed decisions, avoid financial traps, and build a secure financial future for themselves and their families.