MobiKwik has recently forayed in the insurance industry in collaboration with ICICI Prudential Life Insurance Company. It is in the form of digital insurance available through the MobiKwik mobile app. It’s a first of its kind group microinsurance plan launched in India. Rs. 20 per month is a cheap premium for a cover of Rs. 1 lakh life insurance. Let’s check whether you should opt MobiKwik Life Insurance Policy or not?

What is Life Insurance Policy?

Life insurance is the most basic and simple way to secure the family in case of any unwanted life event occurs. In the life insurance plan, the policyholder pays the premium on a monthly/quarterly/yearly basis and gets the life cover in case of an accident happens to the policyholder.

I have written a detailed article on the best insurance company in India. These are all traditional companies offering life cover policy. MobiKwik is the first of its kind to offer a digital insurance policy.

Why you must have a life insurance policy?

Life is uncertain and still, we have plans for our retirement life. There are various reasons as to why you must have life cover to secure your family in case you are not there. Typically the life insurance policy is being taken by the main person in the family who is a bread earner for the entire family.

Below are the main benefits of having a life insurance policy.

- Life insurance policy is actually not for the person whose name the policy is taken. It is actually for the family of that person, in case of an unwanted death happens to the policyholder. It will help the family to survive after the person who was a bread earner for the family.

- It will help to pay off any debt which is taken and being paid by the policy holder. for example, home loan EMI which is being paid regularly by the policyholder every month.

- It also gives you peace of mind that you have a backup plan in case anything happened to you.

- Many of the insurance policy comes with a guaranteed income scheme. In such a scheme, you will get a certain amount in return after the completion of the policy term.

- The policyholder can enjoy the tax benefits on the premium amount paid during the year.

- Life insurance plans provide the flexibility of choosing the plan as per your wish and budget.

MobiKwik Life Insurance Policy Feature

1)It offers life insurance for Rs 20 per month for every Rs 1 Lakh Sum Assured.

2) It offers life insurance for Rs 30 per month for every Rs 1.5 Lakh Sum Assured.

3) It offers life insurance for Rs 40 per month for every Rs 2 Lakh Sum Assured.

- It claims to provide low-cost life insurance cover @ Rs. 20

- Life cover policy up to Rs. 2 lakh.

- A quick and simple purchase like you do your mobile recharge

- Insurance partner is ICICI Prudential Life Insurance, one of the leading insurance company in India.

- Purchasing the policy through MobiKwik is safe and secure.

- The complete paperless online process takes less than a minute to purchase the insurance policy.

- The instant policy would be offered once the process is completed.

How to purchase MobiKwik Life Insurance Policy?

As mentioned above, the life insurance policy purchase will not take more than a minute. Here is a simple process for buying a life insurance policy on MobiKwik app.

- On the MobiKwik app, select Insurance.

- Choose Life Insurance on the Insurance Page

- Go through the terms and conditions and click on the amount you want to get covered with.

- Click on “Make Payment”. Get yourself Certificate of Insurance issued by entering the Personal and Nominee’s Details.

Here is the link of MobiKwik mobile app

MobiKwik Life Insurance – Should You Opt for it?

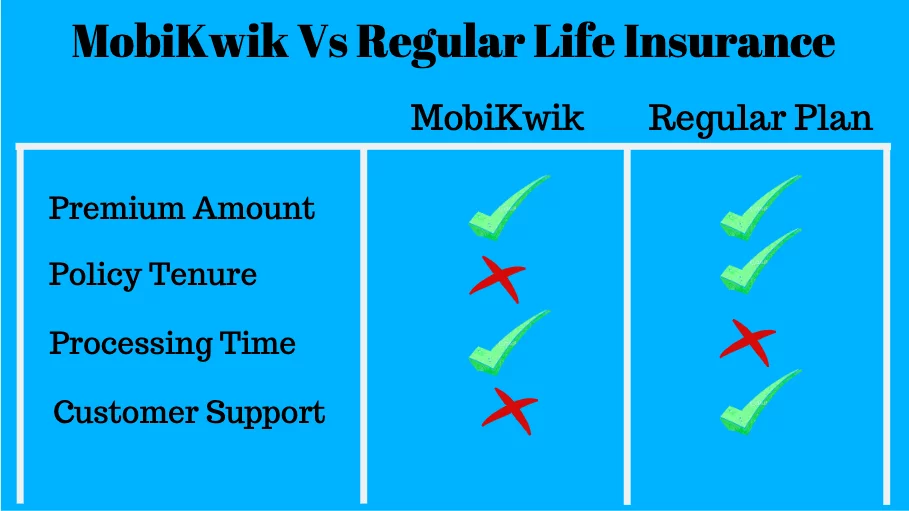

Let’s compare the mobikwik policy with the ICICI life insurance policy. Which is better and why.

Premium Amount: As offered by the MobiKwik, the insurance policy of Rs. 100000 is at Rs. 20/month. So yearly premium for Rs. 1 lakh policy works out to be Rs. 240. While the ICICI Prudential is offering the insurance cover of Rs. 1 lakh at around 200 to 300. So there is no major difference in the policy premium.

Policy Tenure: The policy tenure for the MobiKwik is just for one year. after that, you again have to buy the policy. While ICICI Prudential offers the life cover policy starting from 5 years to 50 years. So in a true sense, ICICI Prudential is the true and complete life insurance policy.

Why one would want to buy the life insurance policy just for one year? usually, life insurance policy is for life long. Another problem is you have to purchase a new policy every year if you buy it through the mobikwik mobile app. So there are chances that you might forget to buy the policy next year and miss out on the life coverage.

Processing Time: Buying a policy through MobiKwik mobile app is quite easy and simple. While buying the same through the ICICI Prudential is a bit cumbersome. It takes around a week time to issue a policy.

Customer Support: This is the aspect most of us are not considering while buying an insurance product. The value of the customer service will only be tested when you actually need to claim your policy. MobiKwik is riding on the ICICI Prudential’s platform and will provide limited access to the insurance company when you actually need it.

On the other hand, ICICI Prudential is a big player in the market and knows in and out of the insurance market. It can definitely provide you better service as compared to the MobiKwik.

Conclusion:

My simple conclusion is to stay away from such short term life cover policy. Life insurance is for a lifetime, why you want to buy it just for a year? What are the benefits you will get apart from the quick buying experience?

Here is the comparison chart for buying an insurance policy through MobiKwik vs regular company.

It is clearly coming out that the regular plans are much better than buying it through the MobiKwik app. It’s just a marketing strategy to tap the subscriber base of the MobiKwik. Both the parties (MobiKwik and ICICI Pru.) will be benefited by this scheme. You as a consumer has nothing much to get out of it.

[jetpack_subscription_form]